Futa Rates By State 2024

Futa Rates By State 2024. For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the futa credit reduction (fcr) in certain states. Sui taxable wage bases, 2023 v.

Department of labor (dol) released its list of potential futa credit reduction states for 2024 [dol, potential 2023 federal unemployment tax act (futa). In new jersey, where no credit reduction exists, the effective futa tax rate is 0.6% for 2023.

6.2% For The Employee Plus 6.2% For The Employer Medicare Tax Rate:

The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa taxable wage base of $7,000 per.

December 7, 2023 · 5 Minute Read.

Federal payroll tax rates for 2024 are:

Suta Tax Rate And Wage Base 2024.

Futa (federal unemployment insurance taxes):

Images References :

Source: blog.taxbandits.com

Source: blog.taxbandits.com

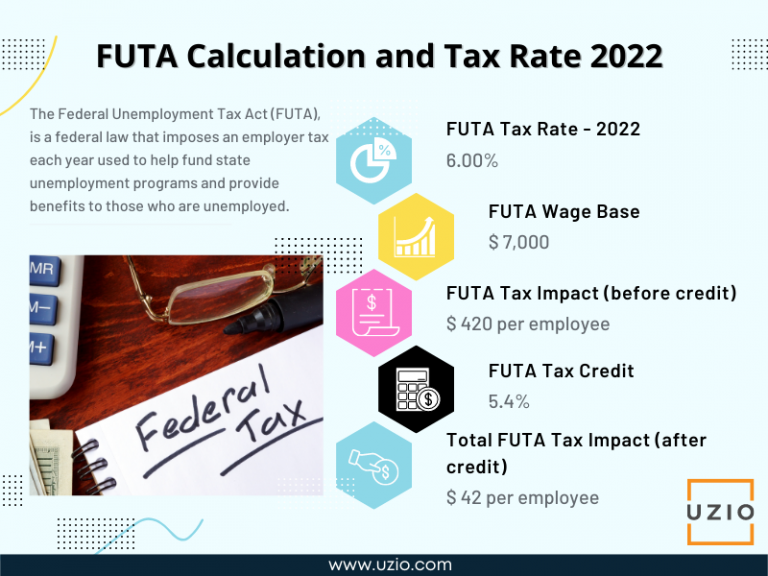

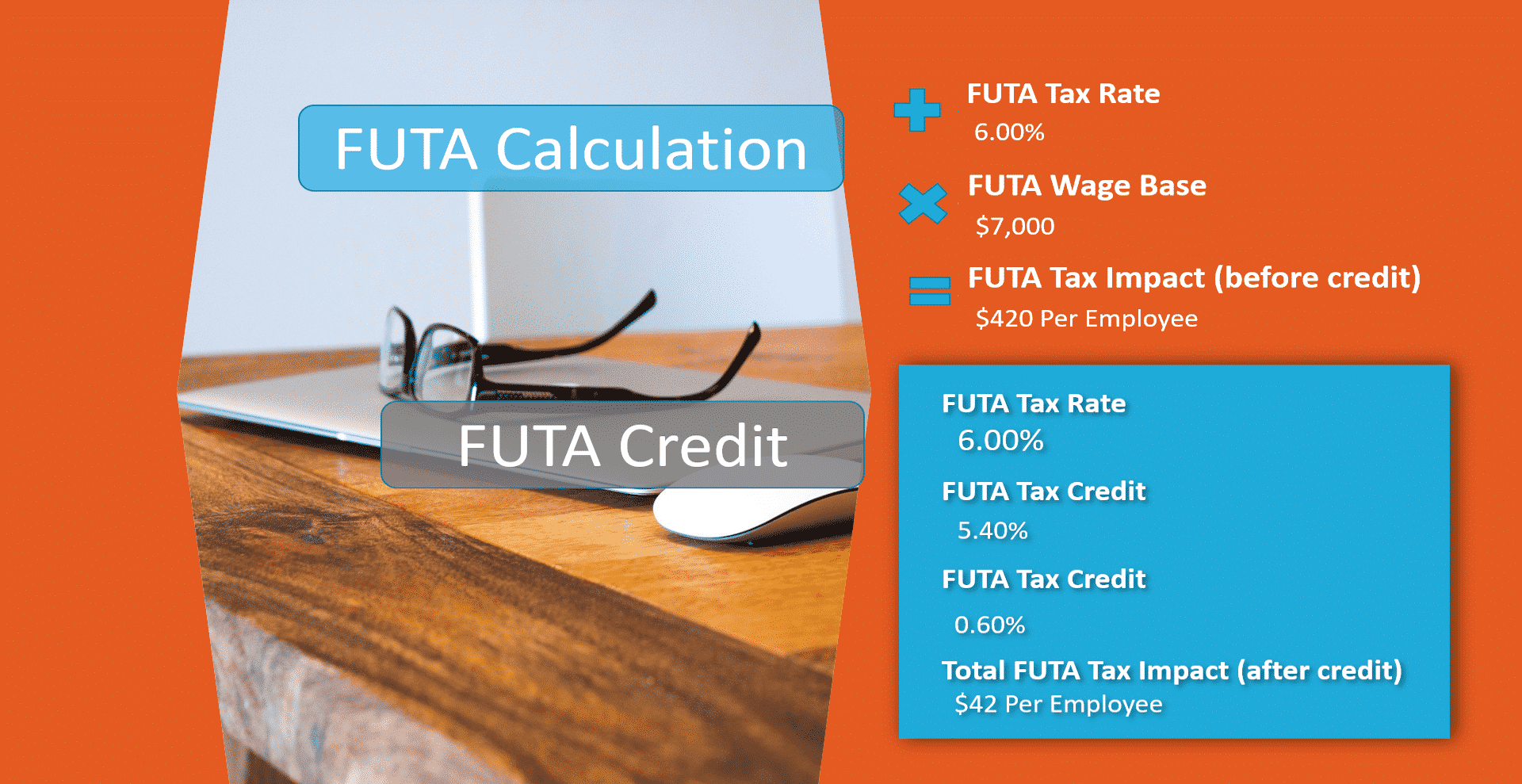

What are FUTA and SUTA Taxes and the 2022 Rates? Blog TaxBandits, Your unemployment insurance tax rates are set at both the federal and state levels. Pursuant to hb 6633 passed in 2021, the unemployment taxable wage base in 2024 will increase to $25,000 from $15,000.

Source: www.taxuni.com

Source: www.taxuni.com

FUTA Tax Rate 2024, 2024 as of january 16, 2024. December 7, 2023 · 5 minute read.

Source: onpay.com

Source: onpay.com

What is the FUTA Tax? 2024 Tax Rates and Info OnPay, Except for the virgin islands, states will a federal ui loan balance on november 1, 2022 will pay a net futa at the rate of 0.9%, rather than a net futa rate of 0.6%. Your unemployment insurance tax rates are set at both the federal and state levels.

Source: www.uzio.com

Source: www.uzio.com

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, This $7,000 is known as the taxable wage base. 2024 as of january 16, 2024.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is FUTA Tax? Rate, Due Dates, & More, Futa tax credit, resulting in the state losing a portion of the futa credit retroactively for 2023. There is no wage base limit for medicare tax.

Source: accuservepayroll.com

Source: accuservepayroll.com

What is FUTA? Federal Unemployment Tax Rates and Information for 2022, Federal payroll tax rates for 2024 are: Keep in mind the wage base is the limit of suta tax.

Source: www.zrivo.com

Source: www.zrivo.com

FUTA Tax Rate 2024 Unemployment Zrivo, Federal payroll tax rates for 2024 are: Social security benefits (earned income may be received without forfeiting.

![FUTA Rate Increases for California [Infographic]](https://blog.accuchex.com/hs-fs/hubfs/ui_tax_increases.jpg?width=1600&height=2400&name=ui_tax_increases.jpg) Source: blog.accuchex.com

Source: blog.accuchex.com

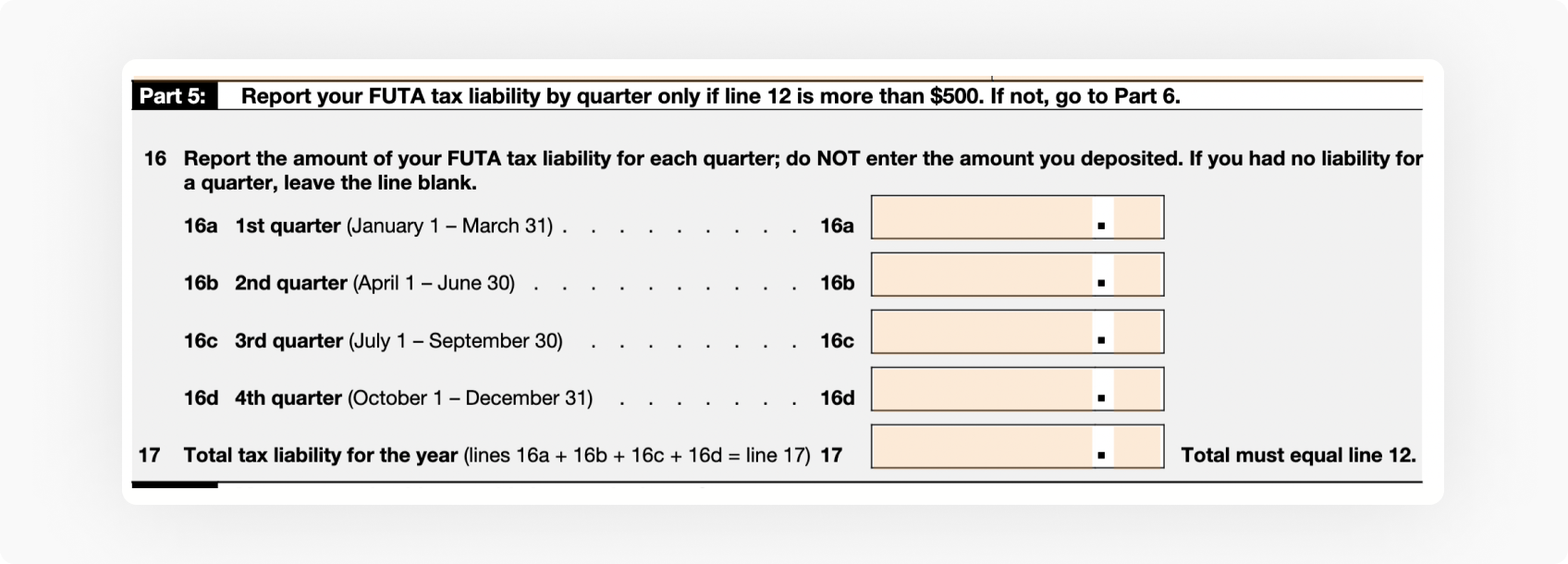

FUTA Rate Increases for California [Infographic], The irs issued the annual form 940 , employer’s annual federal unemployment (futa) tax return, its instructions, and schedule a. The fcr and futa rates that will be.

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, As a result, california is experiencing an additional 0.3% in their futa credit. Generally, if you paid into state unemployment funds, you may receive a credit of up to 5.4% of futa taxable wages when you file your form 940.

Source: blog.pdffiller.com

Source: blog.pdffiller.com

form940instructionsfutataxrate202106 pdfFiller Blog, 2024 as of january 16, 2024. There is no wage base limit for medicare tax.

The Medicare Tax Rate Is 1.45% Each For The Employee And Employer, Unchanged From 2023.

Except for the virgin islands, states will a federal ui loan balance on november 1, 2022 will pay a net futa at the rate of 0.9%, rather than a net futa rate of 0.6%.

Your Unemployment Insurance Tax Rates Are Set At Both The Federal And State Levels.

In california and new york, there is a credit reduction which will result in.

2023 $ 2024 $ Increase Or Decrease.

The fcr and futa rates that will be.

Category: 2024