What Is The Taxable Income For 2024

What Is The Taxable Income For 2024. The seven federal income tax brackets for 2023 and 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The federal income tax system is.

Income in america is taxed by the federal government, most state governments and many local governments. To illustrate, say your income for 2022 includes the.

It Is Mainly Intended For Residents Of The U.s.

Taxable and nontaxable income, publication 525.

These Changes Are Now Law.

Single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits.

You Probably Have To File A Tax Return In 2024 If Your 2023 Gross Income Was At Least $13,850 As A Single Filer Or $27,700 If Married Filing Jointly.

Images References :

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://i.ytimg.com/vi/4MNnk4NFRuw/maxresdefault.jpg) Source: fincalc-blog.in

Source: fincalc-blog.in

Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog, For 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it. You pay tax as a percentage of your income in layers called tax brackets.

Source: valareewflora.pages.dev

Source: valareewflora.pages.dev

Tax Calculator California 2024 Barb Marice, On 25 january 2024, the government announced changes to individual income tax rates and thresholds from 1 july 2024. How much of your income is above your personal allowance;

Source: 2023vjk.blogspot.com

Source: 2023vjk.blogspot.com

10+ Calculate Tax Return 2023 For You 2023 VJK, How much of your income falls within each tax band; The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Taxable and nontaxable income, publication 525. Your bracket depends on your taxable income and filing status.

Source: www.chegg.com

Source: www.chegg.com

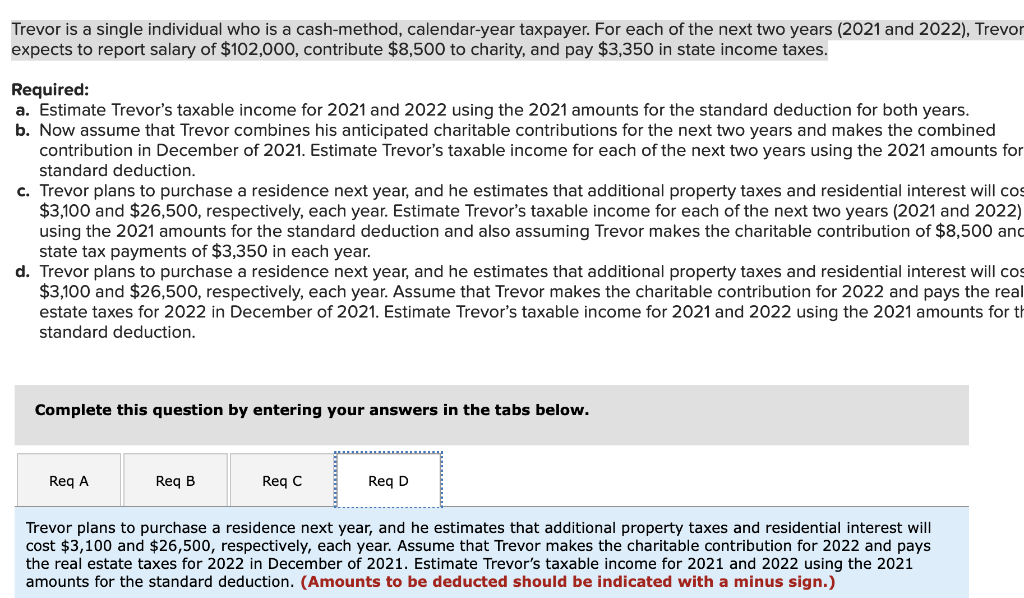

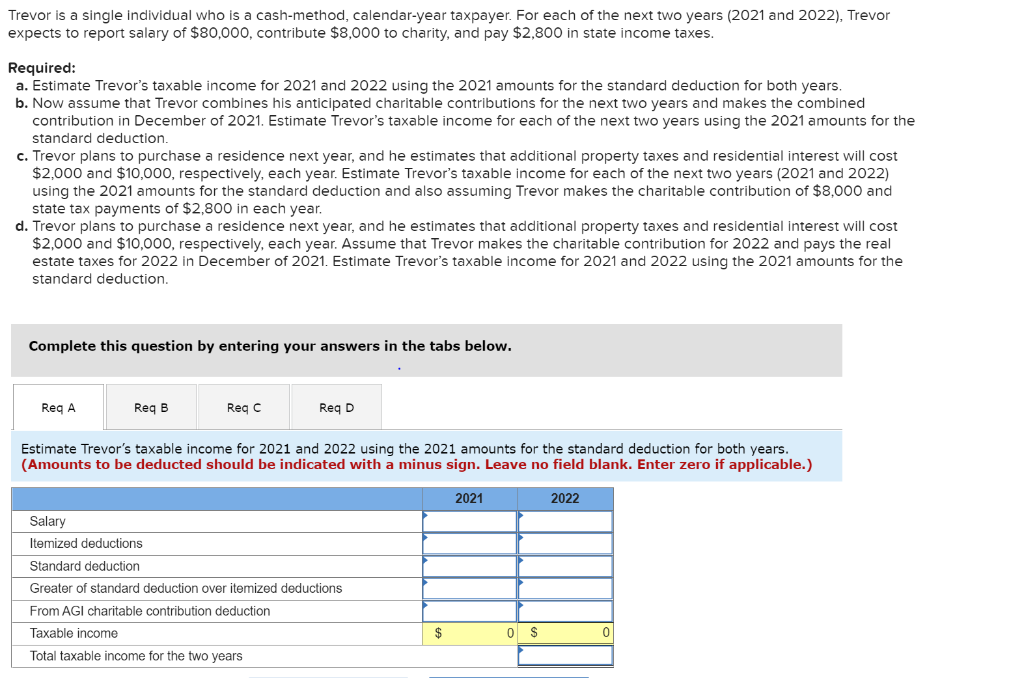

Solved Trevor is a single individual who is a cashmethod,, Add up all sources of taxable income, such as wages from a job, income from a side hustle, investment returns, etc. Single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits.

Source: www.chegg.com

Source: www.chegg.com

Solved Trevor is a single individual who is a cashmethod,, 8 rows credits, deductions and income reported on other forms or schedules. Income in america is taxed by the federal government, most state governments and many local governments.

Source: taxcalculatorphilippines.online

Source: taxcalculatorphilippines.online

BIR Personal Tax Calculator Philippines 2024, Taxable and nontaxable income, publication 525. The tables below can help you compare the brackets and rates for the 2023 tax year and what you can.

Source: aslgate.com

Source: aslgate.com

The difference between taxable and assessable in Vietnam, The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025. Tax rate taxable income (single) taxable income (married filing jointly) 10%:

Source: www.taxwarehouse.com.au

Source: www.taxwarehouse.com.au

Easy Ways to Reduce Your Taxable in Australia Tax Warehouse, See current federal tax brackets and rates based on your income and filing status. The federal income tax system is.

Source: www.chegg.com

Source: www.chegg.com

Solved Problem 327 (LO. 1) Compute the taxable for, Add up all sources of taxable income, such as wages from a job, income from a side hustle, investment returns, etc. Your taxable income and filing status determine which tax brackets.

Below, Cnbc Select Breaks Down The Updated Tax Brackets For.

Tax rate taxable income (single) taxable income (married filing jointly) 10%:

From 1 July 2024, The.

The tables below can help you compare the brackets and rates for the 2023 tax year and what you can.